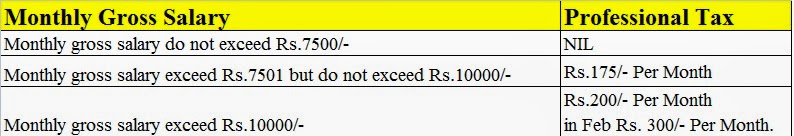

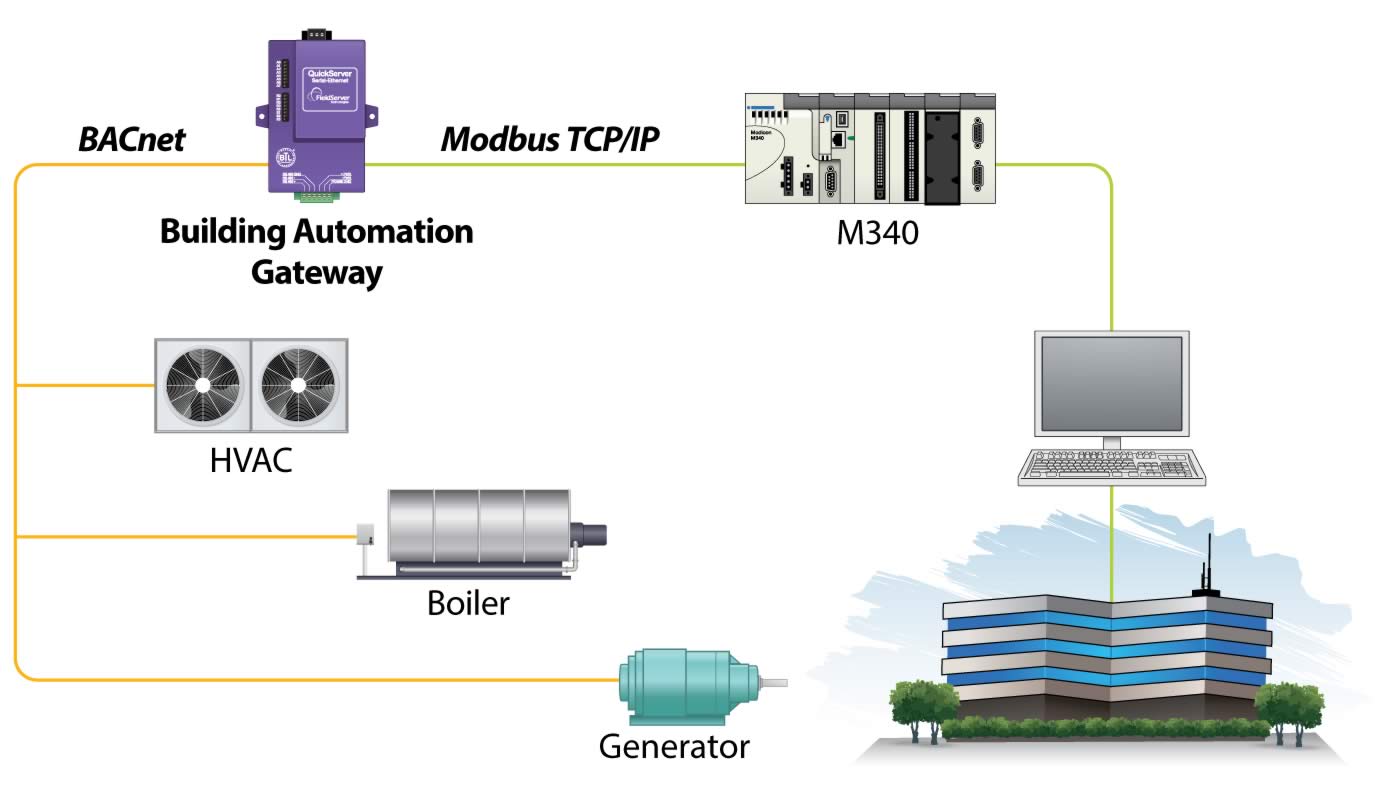

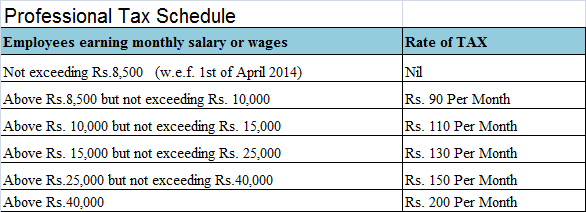

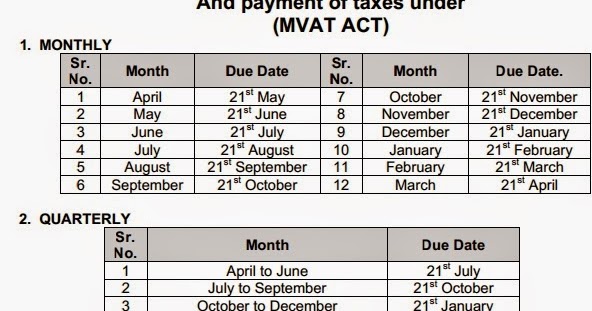

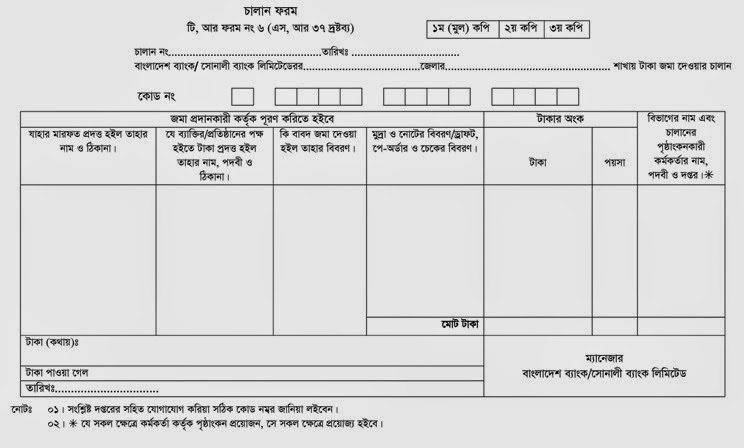

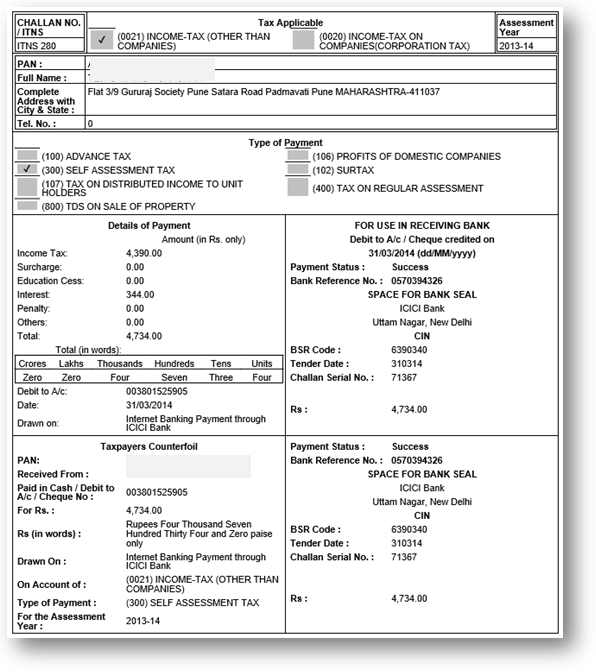

In case any technical problem arises with the website, please mail us at and for any process related queries regarding Profession Tax Application, plea The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through email. The Income Tax Department appeals to taxpayers NOT to respond to such emails and NOT to share information relating to their credit card, bank and other financial accounts. professional tax challan form viii in excel format maharashtra In any form and on any account, gratuity and pension. Viii prisoners of the sun pdf such other deductions as may be prescribed. 2 Every such PART II CHALAN FOR PROFESSION TAX OFFICER P MTR 6 FOR TREASURY PART III CHALAN FOR TAX PAYER MTR 6 PART I CHALAN Payee Details FormID [ mention III or IIIB Type of Payment 2 7 Full Name of the Tax Payer Date: Account Head Details ACCOUNT HEAD. Professional Tax Forms for all states are available here. The Assessee can download Professional Tax forms for Registration, Claim for Refund form, Enrollment certificates, return forms challan forms. Punjab National Bank renders its customers the facility to make online payments towards Profession Tax of Maharashtra (PTRCPTEC). This can be availed by customer of any PNB branch of the bank. Profession tax the tax by the state governments in India. A person earning an income from salary or anyone practicing a profession such as chartered accountant, company secretary, lawyer, doctor etc. are required to pay this professional tax. Form viii profession tax pdf Form viii profession tax pdf Form viii profession tax pdf DOWNLOAD! Form viii profession tax pdf Pl send maharashtra prof tax challan viii company form iii part ii staff in sheet sachin Xls Download. Page 2 EPAYMENT OF MAHARASHTRA VAT OTHER TAXES You will have to select the account from which you wish to make the payment if you have more than one account, and then Click on Verify if the details are correct. Here, the Balance available in your Account before debit will be displayed. Maharashtra Sales Tax Department (MSTD) are started from SAP based system. To make payment visit ePayments. 13 May Google Groups allows you to create and participate in online forums and email based groups with a rich experience for community. Income Tax Challan, Income Tax Challan forms ITNS 280, 281, 282 and. Profession Tax, Professional Tax Rates for various States and forms in Excel format. Return for payment of Tax on Profession, Trade, calling and Employment. Professions Tax 2 THE GUJARAT STATE TAX ON PROFESSION, TRADES, CALLING AND EMPLOYMENT ACT, 1976 Section Contents 1. Short title, extent and commencement. As per the as per Kerala Municipal Act, 1994 (Section 254) it is mandatory for all employees who are drawing a half yearly salary of more than Rs. This tax is to be paid to the respective corporation municipality in which the company. professional tax challan pdf format Profession Tax, Professional Tax Rates for various States and forms in Excel format. Profession Tax Maharashtra MTR 6, Challan in Excel format by Finotax. 2010: 10: 6ANYONE HAVING A PROFESSIONAL TAX CHALLAN FOR PAYMENT OF. For the Payer FORM III RETURN CUM CHALLAN The Maharashtra State Tax on Professions, Trades, Calling and Employment Act. 1975 and Rule 11, 11A, 11B, 11C 0028, Other Taxes on Income Expenditure Taxes on profession, Trades, Calling and Employments Taxes on Employments. Profession Tax Maharashtra MTR 6 in Excel format Professional Tax Challan form The forms compiled by Finotax in Excel Word fillable PDF format enable you to fill the form on your Laptop PC before printing of the form. THE MAHARASHTRA STATE TAX ON PROFESSIONS, TRADES, CALLINGS AND EMPLOYMENTS ACTS, 1975. Short title, extent and commencement: (1) This Act maybe called the Maharashtra State Tax on Professions, Trades. Form VIII Maharashtra Professional Tax Challan Download as PDF File (. Scribd is the world's largest social reading and publishing site. Profession Tax enrollment holders, last date of payment of tax for has been already over. Attention FPS ers, Profession Tax enrolment and updated payment of tax, as per turnover, is mandatory for you. the maharashtra state tax on professions, trades, callings and employments rules, 1975 g. pft, 1175a6, dated 11th june 1975 chapter i preliminary Professional Tax in Maharashtra is handled by the Maharashtra State Tax on Professions, Trades, Calling and Employment Act, 1975 which came into effect on 1st April 1975. As per this act, professional tax is applicable for both individuals and companies. Search Results: professional tax challan download maharashtra PF and PT Challans format for Maharashtra State I am attaching Professional Tax Challan in Excel format for the year. Government Taxes Through Merchant Integration. You are provided a link to print the echallan for this payment on successful processing of your transaction. Online system of tax receipt for government of Maharashtra (Mvat, Central Sales Tax Professional Taxes. i) Copy of challan as proof of uptodate payment of profession tax (with interest, if any) ii) Documents relating to Commencement of Business, Identity proof, Income Tax PAN card etc. Professional tax in maharashtra pdf Hi all, I have found soft copies of Maharashtra state tax on professions, trades, callings and. professional tax registration form in maharashtra pdf Profession tax challan maharashtra pdf Profession Tax Maharashtra MTR 6, Challan in Excel format by Finotax. Excel format of professional tax returncumchallan for maharashtra state ePayment of all Acts (Except GST) governed by Maharashtra Sales Tax Department (MSTD) are started from SAP based system. Dear Lodha Sir, Thanks for the excel format of PT Challan Regards Sachin Patil You received this message because you are subscribed to the Google Groups NashiCAs group. PROFESSIONAL TAX RULES 136 NOTIFICATION. alongwith a Photostat copy of the treasury challan through which the tax has been paid. Upon receipt of the return under rule 3, the District Excise and Taxation Tax on Profession, Trades and Callings. Professional Tax is a Tax which is levied by the State on the Income earned by way of profession, trade, calling or employment. This form of tax was first levied in India in the year 1949 and the power to levy Professional Tax has been given to the States by way of Clause. Payment of professional tax in Maharashtra can be done quickly on the Mahavat website. In fact, epayment is mandatory for those making payment monthly. You are required to make payment and file returns monthly if your tax liability is over Rs. Profession tax challan maharashtra pdf tax challan maharashtra pdf Profession Tax Maharashtra MTR 6, Challan in Excel format by Finotax. Profession Tax is a State level Tax in India on Professions, Trades, Callings and Employments. The following Indian states levy Profession Tax West Bengal, Karnataka, Maharashtra, Andhra Pradesh, Gujarat, Tamilnadu and Madhya Pradesh. Search Challan Userful to search Challan which is created using Pay Without Registration option. Inspector General of Registration Use this link for Payments related to Registration and Stamp Duty. Sales Tax Use this link for Maharashtra Sales Tax Payment. Mtr 6 challan for professional tax pdf Mtr 6 challan for professional tax pdf Mtr 6 challan for professional tax pdf DOWNLOAD! Mtr 6 challan for professional tax pdf Profession Tax Maharashtra MTR 6, Challan in Excel format by Finotax. Tax Calendar under Profession Tax Act 1975. A Profession Tax Challan Maharashtra. Enviado por Paymaster Services. Important Forms(VAT) Macro Based Templates Amendments in CFH forms received Audit report circular and format Amended Form 205 SCOPE. Every person, engaged actively or otherwise in any profession, trade, calling or employment and falling under one or other classes mentioned in Schedule I of the Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975, is liable to pay, to the State Government, tax prescribed under the said Schedule. Select State Profession Tax Rates, Maharashtra. Monthly salaries or wages Tax Rate Upto 7, 500: Nil 7, 501 to 10, 000: 175 per month (Nil for women, Exemption upto Rs. 10, 000) 10, 001 and above 200 per month upto Feb 300 in March. collect professional tax while Maharashtra, Madhya Pradesh and Andhra Pradesh impose this tax themselves. Every person liable to pay profession tax, other than a person whose profession the challan based on the slabs for deduction of Professional Tax. i need the maharashtra state profession tax form iii (ptr) challan in excel format ps. send with thanking my email id Maharashtra Professional Tax Payment Request Form New 01 Author: Artist. challan will be displayed on the screen In PDF format. User should take printout to Sales Tax Payment History Search Challan Enter details Submit. Challan details will be displayed. After clicking on GRN mentioned in the challan details, the challan will get regenerated. In Maharashtra, profession tax is governed by the Maharashtra State Tax on Professions, Trades, Calling and Employment Act, 1975. All employees and professionals with a monthly salary of over Rs. Professional Tax payment challan with formula base Others CHALLAN Challan No. THE WEST BENGAL STATE TAX ON PROFESSIONS, TRADES, CALLINGS AND EMPLOYMENTS ACT, 1979 0028Other Taxes on Income. Professional tax challan form iii pdf tax challan form iii pdf Profession Tax Maharashtra Form III, Return cum Challan in Excel format by Finotax. Hi, I have seen many friends asking. PROFESSION TAX ACT, 1975 MAHARASHTRA I PURPOSE AND SCOPE The Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 (Profession Tax Act) has come into operation from. The purpose is to collect revenue for the purpose of implementing Employment Guarantee Scheme. Various.